In the ever-evolving crypto market, Bitcoin often steals the headlines, but the real action is increasingly happening in the altcoin space. From decentralized finance (DeFi) projects to Web3 infrastructure tokens and AI-driven platforms, altcoins offer diverse opportunities — and risks — that savvy investors cannot ignore. But which altcoins are genuinely outperforming, and what factors are driving their success in 2025?

Let’s break down the current landscape, identify the top-performing tokens, and explore the dynamics shaping their trajectories.

Understanding Altcoins: Beyond Bitcoin

Altcoins, or “alternative coins,” encompass every cryptocurrency other than Bitcoin. They serve multiple purposes:

- Ethereum (ETH): The foundational smart contract platform enabling DeFi, NFTs, and Web3 applications.

- Solana (SOL) and Avalanche (AVAX): High-speed blockchain alternatives with low fees for developers and users.

- DeFi Tokens: Examples include Aave (AAVE) and Compound (COMP), powering decentralized lending and borrowing.

- Layer-2 Solutions: Tokens like Polygon (MATIC) help scale existing blockchains efficiently.

- Emerging AI and NFT Tokens: Cryptocurrencies integrated with artificial intelligence or digital collectibles.

While Bitcoin is primarily a store of value, altcoins are utility-driven, offering real-world applications and innovation, making performance evaluation more complex than simple price charts.

Metrics That Define Outperformance

When analyzing altcoin performance, it’s not just about price appreciation. Investors must consider multiple factors:

- Market Capitalization Growth

A rising market cap indicates growing adoption and investor confidence. While smaller altcoins can surge dramatically, consistent performance often comes from mid- to large-cap tokens with strong ecosystems. - Trading Volume and Liquidity

High trading volume suggests active participation and investor interest. Tokens with low liquidity may be volatile or easily manipulated, making volume a key performance indicator. - Network Activity

Metrics such as the number of active addresses, transaction counts, and smart contract usage highlight real utility and adoption. Altcoins with strong network activity are more likely to sustain long-term value. - Ecosystem Development

Regular updates, developer engagement, and ecosystem growth often correlate with token performance. Active communities drive adoption and innovation, creating a positive feedback loop. - Partnerships and Integrations

Altcoins that collaborate with major platforms, enterprises, or emerging blockchain protocols often gain credibility and broader market exposure.

Top Performing Altcoins in 2025

Based on recent trends, several altcoins are standing out in terms of adoption, innovation, and returns.

1. Ethereum (ETH)

Ethereum remains the backbone of the altcoin ecosystem. Its transition to Ethereum 2.0 has improved scalability and reduced energy consumption, reinforcing confidence among developers and investors alike. With continued growth in DeFi protocols and NFT marketplaces, ETH maintains a strong position.

2. Solana (SOL)

Known for high throughput and low fees, Solana attracts developers seeking speed and efficiency. Its ecosystem of DeFi projects, NFT platforms, and gaming apps has led to strong price performance, particularly among investors looking for next-generation smart contract platforms.

3. Polygon (MATIC)

As a Layer-2 scaling solution, Polygon enhances Ethereum’s network efficiency, enabling faster and cheaper transactions. Its utility in bridging multiple chains has contributed to significant adoption, making MATIC one of the top performers in bridging scalability gaps.

4. Chainlink (LINK)

Chainlink is the leading decentralized oracle network, feeding smart contracts with real-world data. Its performance reflects the growing demand for reliable data in DeFi, insurance, and gaming applications. LINK’s continued expansion in enterprise blockchain solutions has fueled sustained investor confidence.

5. Cardano (ADA)

Cardano’s focus on research-driven development and formal verification continues to attract attention. While adoption has been slower than some competitors, its strategic partnerships and ecosystem growth position ADA as a long-term player in smart contracts and DeFi.

6. Emerging AI and NFT Tokens

New altcoins leveraging AI and NFT utility — such as SingularityNET (AGIX) or The Sandbox (SAND) — are capturing niche markets. Their integration of technology and entertainment creates unique use cases, often driving high short-term returns despite increased volatility.

Factors Driving Outperformance

Altcoin success depends on a blend of technology, adoption, and market sentiment:

- Innovation and Real-World Utility

Tokens that solve practical problems — whether through DeFi, gaming, or AI — tend to attract developers and users, boosting long-term value. - Investor Confidence

Transparent development teams, active communication, and visible roadmap execution build trust, which drives market participation. - Market Trends

Macro trends such as Bitcoin dominance shifts, regulatory clarity, and the rise of decentralized finance influence altcoin performance. For example, increased adoption of Layer-2 solutions often correlates with higher MATIC and SOL activity. - Community Engagement

A strong, active, and committed community can amplify adoption, encourage innovation, and stabilize token value during volatile periods. - Liquidity and Exchange Availability

Altcoins listed on reputable exchanges with high liquidity often outperform those limited to smaller platforms. Easy access increases participation and market depth.

Risks in Altcoin Investing

Despite their potential, altcoins come with unique risks:

- High Volatility: Many altcoins can swing 20–50% in a single day. Short-term investors must brace for turbulence.

- Project Viability: Some projects fail to deliver on their roadmap or lose community support, leading to token depreciation.

- Regulatory Pressure: Governments around the world are scrutinizing crypto projects, particularly DeFi and tokenized assets, which may impact adoption and legality.

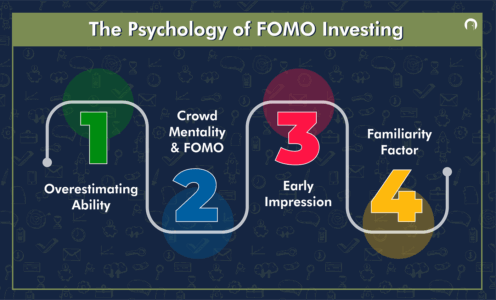

- Market Sentiment: FOMO-driven buying can create temporary spikes, followed by rapid corrections.

Investors must combine technical analysis, fundamental research, and risk management to navigate these challenges effectively.

The Role of Bitcoin in Altcoin Performance

It’s impossible to analyze altcoins without considering Bitcoin’s market influence. Historically, Bitcoin acts as a bellwether:

- When Bitcoin rallies, altcoins often follow, sometimes with higher multiples due to their smaller market caps.

- When Bitcoin declines sharply, altcoins tend to experience amplified losses, given their higher volatility.

Understanding this dynamic allows investors to time entries, exits, and portfolio allocation more strategically.

Portfolio Strategy for Altcoin Investors

Given the diversity and risk profile of altcoins, a well-balanced strategy is essential:

- Diversification Across Categories

Allocate across smart contract platforms, DeFi tokens, Layer-2 solutions, and emerging AI/NFT projects. - Long-Term and Short-Term Mix

Hold a core portfolio of proven projects like ETH, SOL, and MATIC, while experimenting with smaller, high-potential altcoins for higher returns. - Active Monitoring

Track network activity, project updates, and market trends to adjust exposure dynamically. - Risk Management

Use stop-losses, position sizing, and secure wallets to protect investments from extreme volatility or security breaches.

Final Thoughts: Navigating the Altcoin Landscape

Altcoins represent the innovation engine of the cryptocurrency ecosystem. They are where experimentation, creativity, and cutting-edge technology converge — from DeFi lending protocols to AI-driven NFT platforms. While they carry higher risk than Bitcoin, their potential for outsized returns is undeniable.

Investors who approach altcoins with a strategic mindset, analytical approach, and disciplined risk management are more likely to identify tokens that outperform over the long term. The key is understanding that success isn’t just about chasing hype, but analyzing metrics, adoption trends, and technological viability.

In 2025, the altcoin market continues to mature. By focusing on utility, adoption, and community-driven growth, investors can separate fleeting trends from genuinely transformative tokens — capturing opportunities in a rapidly evolving digital frontier.